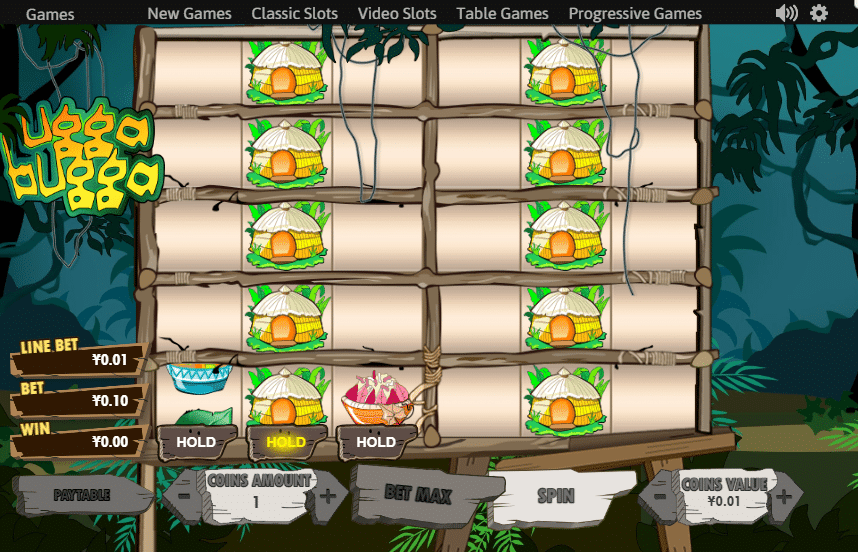

Slot machines without registration

All ATMs have €50, €20, €10 notes and some ATMs have €5 notes. The individual machine indicates which notes are available. You can withdraw up to €2,000 per transaction depending on the availability of the ATM https://motisgrill.com/. If you want to withdraw €10,000, you can do so by making five transactions.

Look for a machine that is intuitive and easy to use for your employees. Furthermore, consider the ease of maintenance and the availability of technical support to resolve any issues that may arise. Be sure to consult with the provider about the equipment’s warranty and maintenance policies.

You cannot withdraw foreign money using a Geldmaat machine in the Netherlands. You can withdraw your foreign currency at a currency exchange office. These offices are often located near airports or train stations. Please note that it is often cheaper to withdraw money in your destination country. There is also an exchange rate for foreign currency, which is set each day. View all fees or calculate the exchange rate directly.

Automated teller machines (ATMs) link your debit card to your checking account, giving you full access to your funds. As most machines accept all cards, you can most likely use any ATM, no matter who you bank with.

The proper use of cash handling machines requires adequate training for staff. This may involve additional time and resources to provide the necessary training, which could cause disruptions in daily operations during the training process.

Deposit bonuses

We monitor bonuses, rates, fees and other account details from the following banks and credit unions to determine the best bank bonuses: BMO Harris, Fifth Third Bank, Truist, Alliant Credit Union, Axos Bank, Bank of America, Chase, Citibank, Citizens Bank, Current, Huntington Bank, M&T Bank, PNC Bank, PSECU, SoFi, TD Bank, GTE Financial, HSBC, Amalgamated Bank, Ally Bank, Aspiration, Aspiration Account, Aspiration Plus, BancorpSouth Bank, Bank5 Connect, BankDirect, BankPurely, BBVA, Blue Federal Credit Union, Capital One, Charles Schwab Bank, Chime, CIT Bank, Connexus Credit Union, Consumers Credit Union, Discover, E*Trade Bank, EBSB, First Internet Bank, FNBO Direct, GoBank, Heritage Bank, HSBC Direct, iGoBanking, Investors eAccess, LendingClub, Memory Bank, Monifi, My eBanc, Navy Federal Credit Union, nbkc Bank, Paramount Bank, PenFed, Quontic, Radius Bank, Redneck Bank, Regions Bank, Rising Bank, SalemFiveDirect, Simple, State Farm Bank, SunTrust Bank, TAB Bank, EverBank, U.S. Bank, USAA, Varo Bank, Wells Fargo.

1SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at See the SoFi Plus Terms and Conditions at

We monitor bonuses, rates, fees and other account details from the following banks and credit unions to determine the best bank bonuses: BMO Harris, Fifth Third Bank, Truist, Alliant Credit Union, Axos Bank, Bank of America, Chase, Citibank, Citizens Bank, Current, Huntington Bank, M&T Bank, PNC Bank, PSECU, SoFi, TD Bank, GTE Financial, HSBC, Amalgamated Bank, Ally Bank, Aspiration, Aspiration Account, Aspiration Plus, BancorpSouth Bank, Bank5 Connect, BankDirect, BankPurely, BBVA, Blue Federal Credit Union, Capital One, Charles Schwab Bank, Chime, CIT Bank, Connexus Credit Union, Consumers Credit Union, Discover, E*Trade Bank, EBSB, First Internet Bank, FNBO Direct, GoBank, Heritage Bank, HSBC Direct, iGoBanking, Investors eAccess, LendingClub, Memory Bank, Monifi, My eBanc, Navy Federal Credit Union, nbkc Bank, Paramount Bank, PenFed, Quontic, Radius Bank, Redneck Bank, Regions Bank, Rising Bank, SalemFiveDirect, Simple, State Farm Bank, SunTrust Bank, TAB Bank, EverBank, U.S. Bank, USAA, Varo Bank, Wells Fargo.

1SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at See the SoFi Plus Terms and Conditions at

We picked SoFi because it offers high-yield savings, an interest rate on checking account balances and a substantial bonus if you’re able to receive eligible direct deposits of $5,000 or more within 25 days of account opening.

Small depositors are often sticky. Banks value sticky depositors because they are less likely to move their funds around once they open an account. Bank bonuses are a very attractive tool for a bank to expand its sticky deposit base.

Slots with high RTP

Also, Casino Hold’em has a relatively low house edge and therefore a high RTP percentage. With in-depth knowledge of the casino game, moves can be analyzed and the best move for that moment can be found. In the same turn, the house edge decreases further.

While slot machines with the highest RTP on the market, such as Mega Joker, appeal the most, you’ll find loads of great titles with 95% RTP. These slot machines have a medium-low Return to Player rate but often make up for it with frequent smaller wins, more bonus rounds, and being compatible with nearly all casino bonuses.

And pretty much all of these games come with the 96% RTP rating that RTG is known for — though the wide variety of jackpot games tend to dip a little lower, this is pretty standard for progressive jackpots.

Also, Casino Hold’em has a relatively low house edge and therefore a high RTP percentage. With in-depth knowledge of the casino game, moves can be analyzed and the best move for that moment can be found. In the same turn, the house edge decreases further.

While slot machines with the highest RTP on the market, such as Mega Joker, appeal the most, you’ll find loads of great titles with 95% RTP. These slot machines have a medium-low Return to Player rate but often make up for it with frequent smaller wins, more bonus rounds, and being compatible with nearly all casino bonuses.

And pretty much all of these games come with the 96% RTP rating that RTG is known for — though the wide variety of jackpot games tend to dip a little lower, this is pretty standard for progressive jackpots.